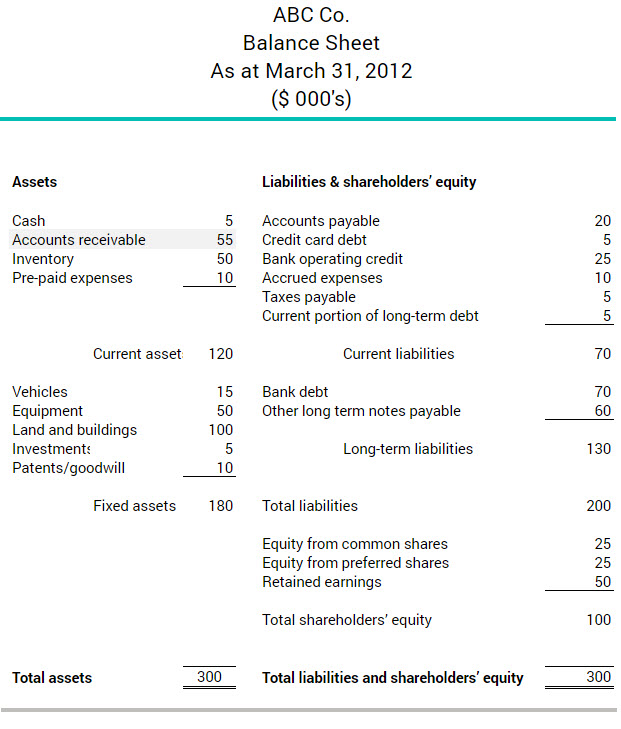

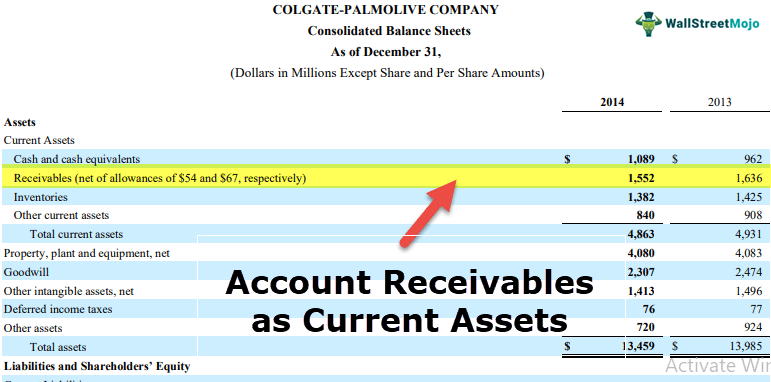

Found in the current assets section of the balance sheet Balance Sheet The balance sheet is one of the three fundamental financial statements. In this case 365x 45 days.

What Is Accounts Receivables Examples Process Importance Tally Solutions

A company can record the transfer of accounts receivable as a sale if all of the following are true except the transferred assets have been isolated from the transferor.

. Accounts Receivable Turnover Ratio Net Credit SalesAverage Accounts Receivable 200000 3000020000 400002 17000030000 566 times. The average collection period is computed as 365 days the accounts receivable turnover ratio. The number of days in the year use 360 or 365 divided by the accounts receivable turnover ratio during a past year.

Sales issued on a credit card or any credit system to be paid at a later date. Accounts receivable sales returns and allowances b. Company management believes days on sales outstanding will decline to 60 days in response to a more stringent credit collection policy.

Thus Ace Paper Mill will collect its average accounts receivables close to 566 times over the year ending December 31 2019. 26 ________ involves the sale of accounts receivable. When an accounts receivable aging schedule is prepared a series of computations is made to determine the estimated uncollectible accounts.

Owed to a company by its customers from the sale of goods or services on account. Accounts Receivable end 150 000 - 9 000 600 000 - 412 000 2 000. Accounts Receivable often abbreviated AR or AR is an accounting term that refers to any of the following.

Number of Days Sales in Receivable 365 22. Accounts Receivable end AR beg Write-offs net credit sales - collection of AR recoveries. Round interim calculations to the nearest dollar and final answers to one decimal place.

ACCOUNT RECEIVABLE TURNOVER Account Receivable Turnover Sales Average Account Receivable. This is referred to as credit or payment terms. So the accounts receivable turnover ratio is 81.

This preview shows page 546 - 549 out of 564 pages. Bad accounts previously written off prior to 2016 amounting to P40000 were recovered. 2021 2020 Accounts Receivable 145950 97735 Net Sales 1905200 1463820 Required Calculate the accounts receivable turnover and the average collection period for accounts receivable in days for 2021.

Which of the following client explanations would satisfy the auditor. The seller may use its accounts receivable as collateral for a loan or sell them off to a factor in exchange for immediate cash. Net Credit Sales Credit Sales Cash Sales Net Credit Sales 1 000 000 - 400 000 40 of 1 000 000 Net Credit Sales 600 000.

19 Jan 31 The Company paid a repair bill of 6000 was paid. 17 Jan 31 Collected cash of 49000 from the accounts receivable plus there was a total sales discount of 1000 for the payment of receivables within the ten day discount period. Accounts Receivable refers to sales that have occurred on credit meaning that the company has not yet collected the cash proceeds from these sales.

The following Accounts Receivable and Sales information was provided to you from Mastercraft Wood Workers Supply Company. Companies generally expect to collect accounts receivable within 30. As this entry shows the debit part of the entry is to the Allowance account.

The transferee obtains the right to exchange. The days sales in accounts receivable can be calculated as follows. What are Accounts Receivable.

A Trust receipt loan B Factoring C Field warehouse arrangement D Pledging of accounts receivable Answer. Explain how companies recognize accounts receivable. Assume a 365-day year.

Accounts receivable may be further subdivided into trade receivables and non trade receivables where trade receivables are from a companys normal business partners and non trade receivables are all other receivables such as amounts. Unpaid or outstanding invoices. Sales discounts cost of goods sold.

So average AR are 300000. The transferee obtains the risks of ownership. This is referred to as credit or payment terms.

The sales ledger is used by the accounts receivable departments. Account Receivable Turnover 22 NUMBER OF DAYS SALES IN RECEIVABLE Number of Days Sales in Receivable Number of Days in a Year Account Receivable Turnover. The entry is not to the Uncollectible Accounts Expense account because we are assuming that the 6000 is included in the 12500 debit to expense as part of the December 31 2019 adjusting entry.

RECEIVABLES Amounts due from individuals and companies that are expected to be collected in cash 1. The amount of cash. The transferor can repurchase the transferred assets before their maturity.

Which of the following accounts are used when recording the sales entry of a sale on credit. The credit part is to Accounts ReceivableCorona. Which of the following best describes accounts receivable.

Accounts receivable is normally handled in most businesses by creating an invoice and mailing or electronically transmitting it to the customer who must then pay it within a certain time frame. For example if a companys accounts receivable turnover ratio for the past year was 10 the days sales in accounts receivable was 36 days 360 days divided. When added to the total accounts written off during the year is the desired credit balance of the allowance for doubtful accounts at year-end.

Number of Days Sales in Receivable 1659. A greater percentage of accounts receivable are listed in the more than 120 days overdue category than in the prior year. Accounts receivable sales returns and allowances.

Net sales average receivables net the accounts receivable turnover ratio. Sales 755550 Average accounts receivable net 32850 Determine a the accounts receivable turnover and b the number of days sales in receivables. The sales ledger is used by the accounts receivable departments.

Accounts Receivable Analysis A company reports the following. Amounts customers owe on account that result from the sale of goods and services. Sales on account P38400000.

Download Accounts Receivable With Aging Excel Template Exceldatapro Excel Templates Accounts Receivable Statement Template Which of the following best describes credit sales. Sales returns and allowances purchases d. 18 Jan 31 Salary expenses in the amount of 12000 and tax expenses in the amount of 5000 were paid.

Internal control activities over the recording of cash receipts have been improved since the end of the prior year. The resulting amount from this aging schedule a. Accounts receivable is normally handled in most businesses by creating an invoice and mailing or electronically transmitting it to the customer who must then pay it within a certain time frame.

Use of Accounts Receivable as Collateral Learning Obj. Accounts receivable sales b. Involves the sale of accounts receivable a trust.

Which of the following best describes accounts receivable. Money that is expected from customers. Cash received from collection of current receivable totaled P31360000 after discount of P640000 were allowed for prompt payment.

2430000Average AR 81. Customers accounts of P160000 were ascertained to be worthless and were written off. Accounts receivable cash c.

What Are Accounts Receivable Bdc Ca

0 Comments